Green aspects in macroprudential policy

As a macroprudential authority, the MNB monitors and, as necessary, mitigates systemic risks threatening the stability of the financial system, especially the banking system, with strong legal power. The details of the related strategy, policy and toolbox are discussed in the macroprudential policy subpage of the MNB.

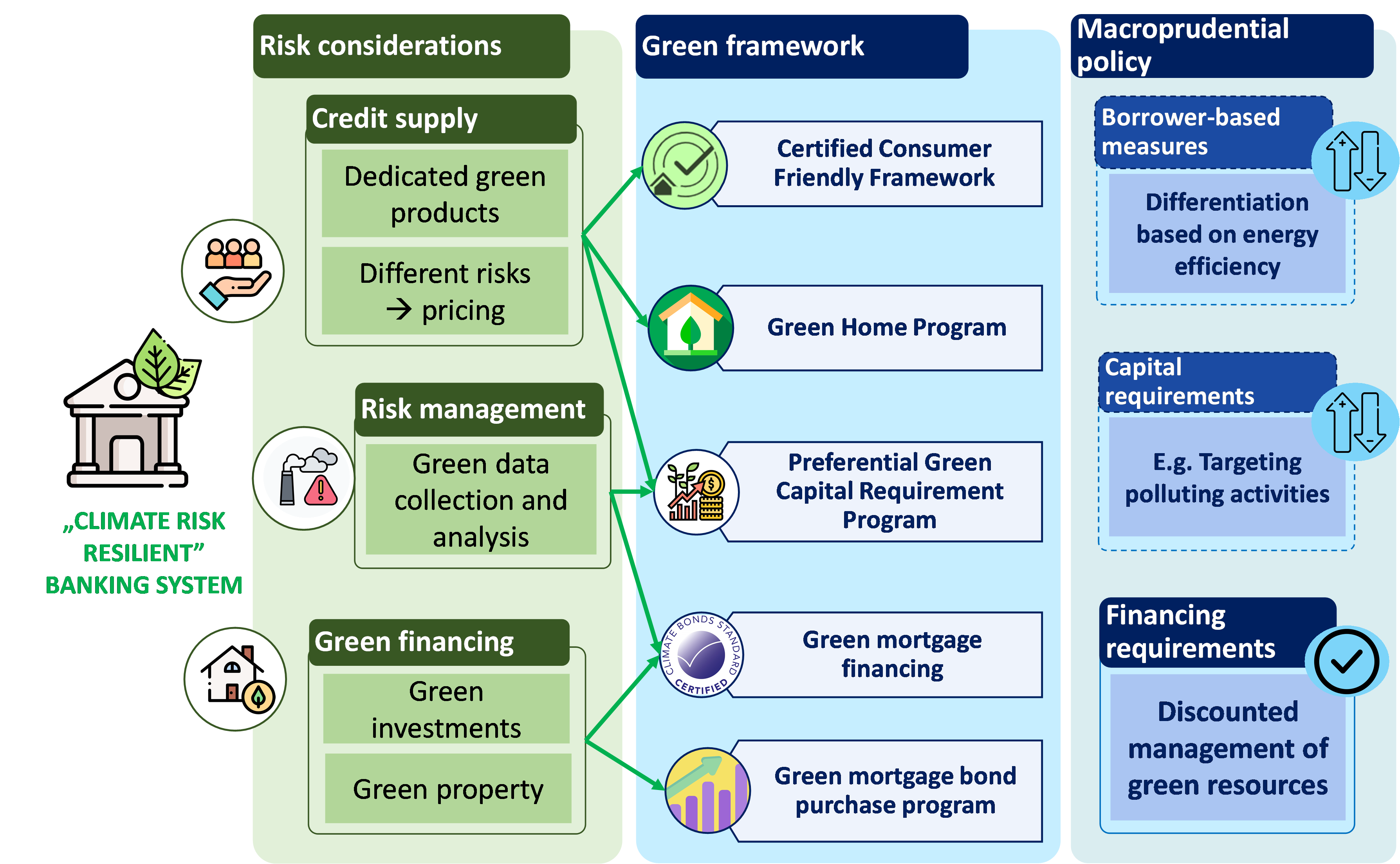

The physical damage and economic-technological adaptation costs resulting from climate change can also significantly increase the risk of credit institutions indirectly through real economic performance and changes in the value of collateral used to cover loans. The banking system can take an active role in greening the economy by financing projects that support this, for example by providing loans aimed at modernizing outdated buildings and building energy-efficient buildings. In this way, the banking system can also reduce its exposure to the risks of climate change and also contribute to the reduction of systemic risks, if on the basis of the so-called "green hypothesis", for example, it is confirmed that green properties or corporate projects are more stable in value, and thus loans using them as collateral are more stable and less exposed to credit risk.

Macroprudential policy aspects of climate risks

Macroprudential regulation can also contribute to supporting the green transition and managing the above-mentioned systemic risks. Accordingly, the Macroprudential Strategy of the MNB takes into account the analysis and management of new types of risks, as well as the development and support of a financial system that sustainably supports economic growth and strengthens environmental sustainability.

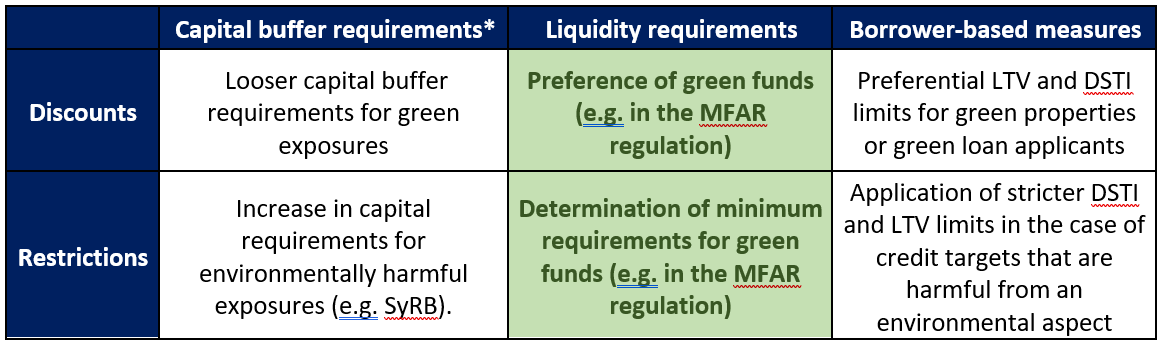

In connection with the fine-tuning of macroprudential policy tools in a green direction, both prohibitive or restrictive measures defining minimum green requirements, as well as measures relying on positive incentives and preferring activities that are less risky from an environmental point of view, may arise. During the development of financial regulation, special attention must be paid to ensuring that, in addition to mitigating climate risks and environmental damage, financial stability goals are not jeopardized. On the one hand, in the case of regulations that do not incorporate green goals to a sufficient extent and in a timely manner, their fulfilment may slow down, which may cause significant damage in the longer term, not only from a social but also a financial stability point of view. On the other hand, due to the lack of empirical information for the time being, it must be ensured that the appropriate mitigation of prudential risks does not take a back seat in the short term.

Possible integration of green aspects within the macroprudential toolbox

Note: in green the already implemented *Green aspects are already present in the Hungarian microprudential capital requirements through the Preferential Green Capital Requirement Discount Program. Note: SyRB: Systemic Risk Buffer; MFAR: Mortgage Funding Adequacy Ratio; LTV: Loan to Value Ratio; DSTI: Debt Service to Income Ratio, Source: Based on the 2021 Macroprudential Report

Several elements of the macroprudential toolkit are suitable for mitigating climate risks and taking green aspects into account:

- Regarding the liquidity and financing regulations, the modification of the Mortgage Funding Adequacy Ratio (MFAR) in this direction has already been successfully implemented, but other modifications may be justified in the future.

- Among the capital requirements, mainly the Systemic Risk Buffer (SyRB) can be considered due to its flexibility, for example by prescribing higher buffer rates for environmentally riskier exposures, increasing the cost of funds for such exposures, thus disincentivizing bank financing of such activities and at the same time increasing banks' resilience.

- In the longer term, if the green hypothesis is justified, the borrower-based measures may be relaxed with regard to green exposures, or even tightened in the case of more environmentally polluting properties.

The MNB reports in detail on the financial stability aspects of climate risks and the macroprudential risk management options in the annual Macroprudential report.

More details on the green aspects of the Mortgage Funding Adequacy Ratio (MFAR).

Other instruments with financial stability relevance

In order to promote the energy modernization of the residential real estate stock, the development of dedicated green home loan products, and to encourage bank sector financing of green credit goals, the MNB decided to introduce Certified Consumer-friendly Housing Loans (CCHL) with dedicated green loan objective from April 1, 2023.

In the case of green CCHL products, no fee or other costs related to the disbursement, or the verification of the green loan purpose can be charged, and the credit provider will assume the one-time cost of the Energy Efficiency Certificate required to prove the fulfilment of the green loan objective, charged to the debtor. In addition, lenders can also provide a green interest rate discount in the case of certified fulfilment of green loan objective.

More details about the green Certified Consumer Friendly Housing Loan (CCHL) products.