The MNB is one of the first in Europe to apply legally binding borrower-based rules from 1 January 2015. The instruments introduced in MNB Decree 32/2014 (IX. 10.) on the regulation of the loan-to-value ratio and the debt-service-to-income ratio (hereinafter: Borrower-based Measures Regulation (available in Hungarian) comprise the so-called Loan-to-Value ratio (LTV) and the Debt-Service-to-Income ratio (DSTI).

In order to facilitate the bank financing of green real estate and thereby support the improvement of the energy efficiency of Hungarian real estate, the MNB decided on the green differentiation of the borrower-based measures. Based on the amendment, from January 1, 2025, green aspects will also be incorporated in the regulation: higher DSTI and LTV limits will be applicable in the case of real estate purchases and loans for renovation purposes that finance the purchase and construction of energy-efficient apartments and efficiency-enhancing renovations.

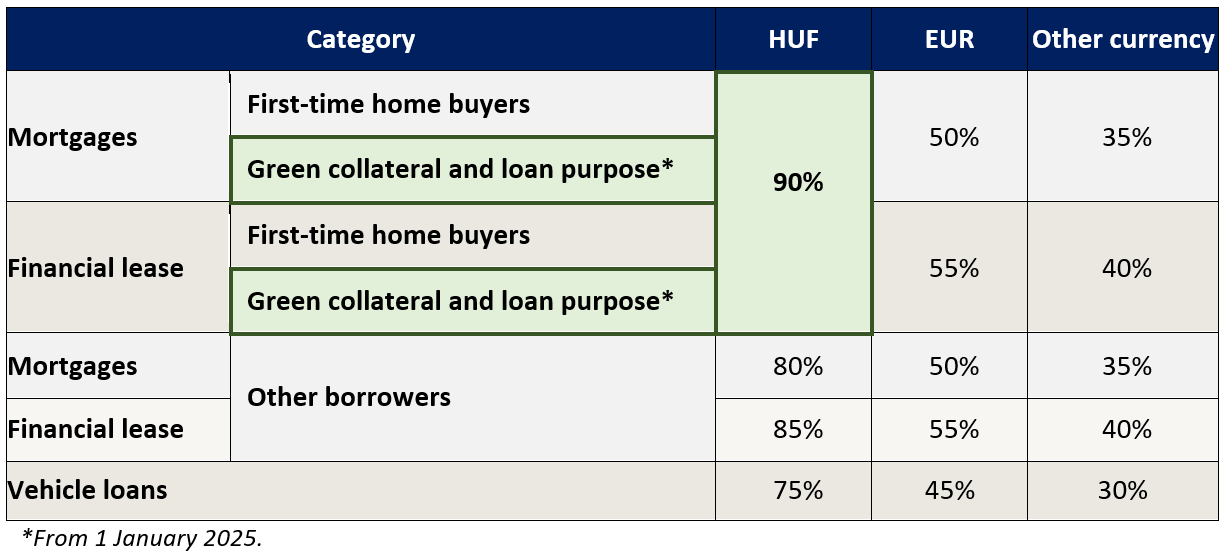

Loan-to-Value ratio (LTV)

The Loan-to-Value ratio shows the maximum amount of credit that borrowers can borrow in proportion to the market value of the collateral determined at the time of credit assessment.

In the case of HUF mortgage loans with a fixed interest rate of at least 10 years that meet the conditions for green collateral and loan purposes determined in the Borrower-based Measures Regulation, the LTV limit increases from 80 percent to 90 percent as of 1 January 2025 (regardless of whether the debtor is a first-time home buyer).

LTV limits

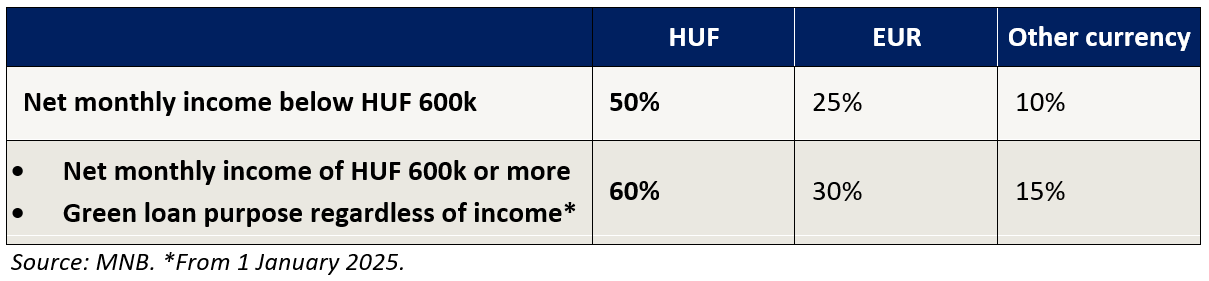

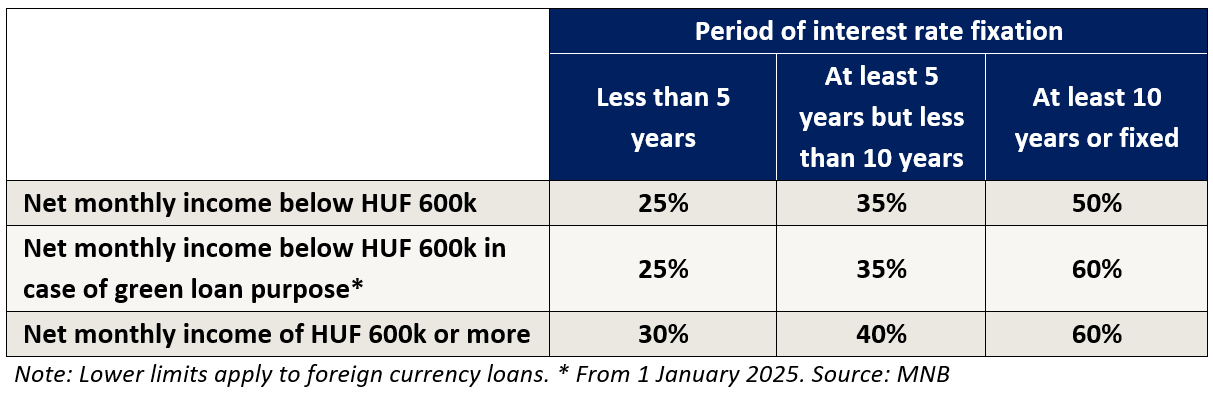

Debt-Service-to-Income ratio (DSTI)

The Debt-Service-to-Income ratio sets the maximum repayment rate that borrowers can afford as a percentage of their monthly net, certified, regular income.

In order to encourage the financing of green loan purposes by the banking sector, the MNB has decided that from January 1, 2025, the 60 percent DSTI limit will be available regardless of income for forint loans with an interest rate fixation of at least 10 years or a maturity of less than 5 years.

Limits of DSTI for unsecured mortgages with a maturity of less than 5 years and unsecured loans

Limits of DSTI for HUF mortgage loans with a maturity of at least 5 years

Green Loan Purposes

The purchase or construction of an energy-efficient real estate or the renovation of a residential real estate for energy efficiency purposes is considered a green loan purpose and green collateral in case it meets the following criteria:

- Energy-efficient real estate: residential real estate where the calculated value of its total energy characteristic is no more than 68 kWh/m²/year defined in accordance with EKM decree 9/2023 (V. 25.) on the determination of the energy characteristics of buildings and which has an "A+" or higher energy quality classification in accordance with Government Decree 176/2008. (VI. 30.) on the certification of the energy characteristics of buildings.

- Renovation of residential real estate

for energy efficiency purposes: renovation that

a) at the time of submitting the loan application affects an apartment classified lower than "A" according to Government Decree 176/2008 (VI. 30.), and as a result of the renovation the apartment reaches the energy classification of minimum "A" defined in Government Decree 176/2008. (VI. 30.) and the calculated value of its total energy characteristic determined according to EKM decree 9/2023. (V. 25.) does not exceed the level of 76 kWh/m2/year, or

b) affects residential real estate where the renovation results in a reduction of primary energy usage of at least 30%, compared to the aggregated energy characteristics included in the authentic energy efficiency certificate issued according to Government Decree 176/2008 (VI. 30.) and valid at the time of submitting the loan application.

The measures aim to strengthen domestic green home loan issuance, which is still in its infancy; this can also support the mitigation of prudential risks. Based on the so-called green hypothesis, the financing of energy-efficient properties may have a lower credit risk. Due to the lower maintenance costs, the borrowers can spend a larger proportion of their income on loan repayment, therefore their probability of default can be lower. In addition, the demand for green real estate collateral can be more resilient compared to less efficient real estates, i.e., the value of these real estates can be more stable during a crisis.

Further information

about the MNB’s Borrower-based measures is available on the MNB’s website:

Borrower-based

measures (LTV, DSTI)