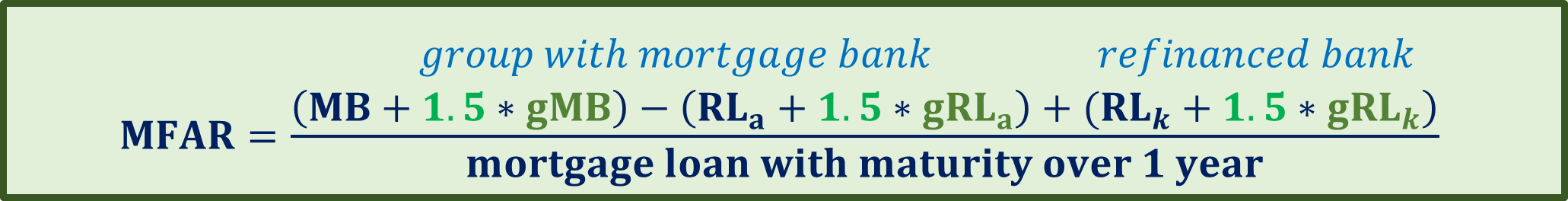

The Mortgage Funding Adequacy Ratio (MFAR) announced by the MNB in June 2015 and effective from 1 April 2017 ensures the long-term financing of residential mortgage loans with mortgage-based resources in the banking system. According to the regulations, the stock of residential HUF mortgage loans with a remaining maturity of more than 1 year must be financed in a specified proportion with long-term HUF funds raised as collateral for residential mortgage loans. Currently, this minimum requirement is 25 percent.

In order to achieve the goals set in the Green Program and to further develop the mortgage bond market, the MNB has made it possible to include green funds preferentially in the MFAR. As of 1 July 2021, green mortgage-based liabilities can be taken into account with a favourable weight of 1.5 when calculating the indicator, if instead of the generally expected minimum 3 years, the original maturity is at least 5 years.

The calculation of the MFAR considering the incentive of green mortgage bonds

Note: where MB non-green mortgage bond, gMB green mortgage bond, RLa extended non-green refinancing loan, gRLa extended green refinancing loan, RLk received non-green refinancing loan, gRLk received green refinancing loan.

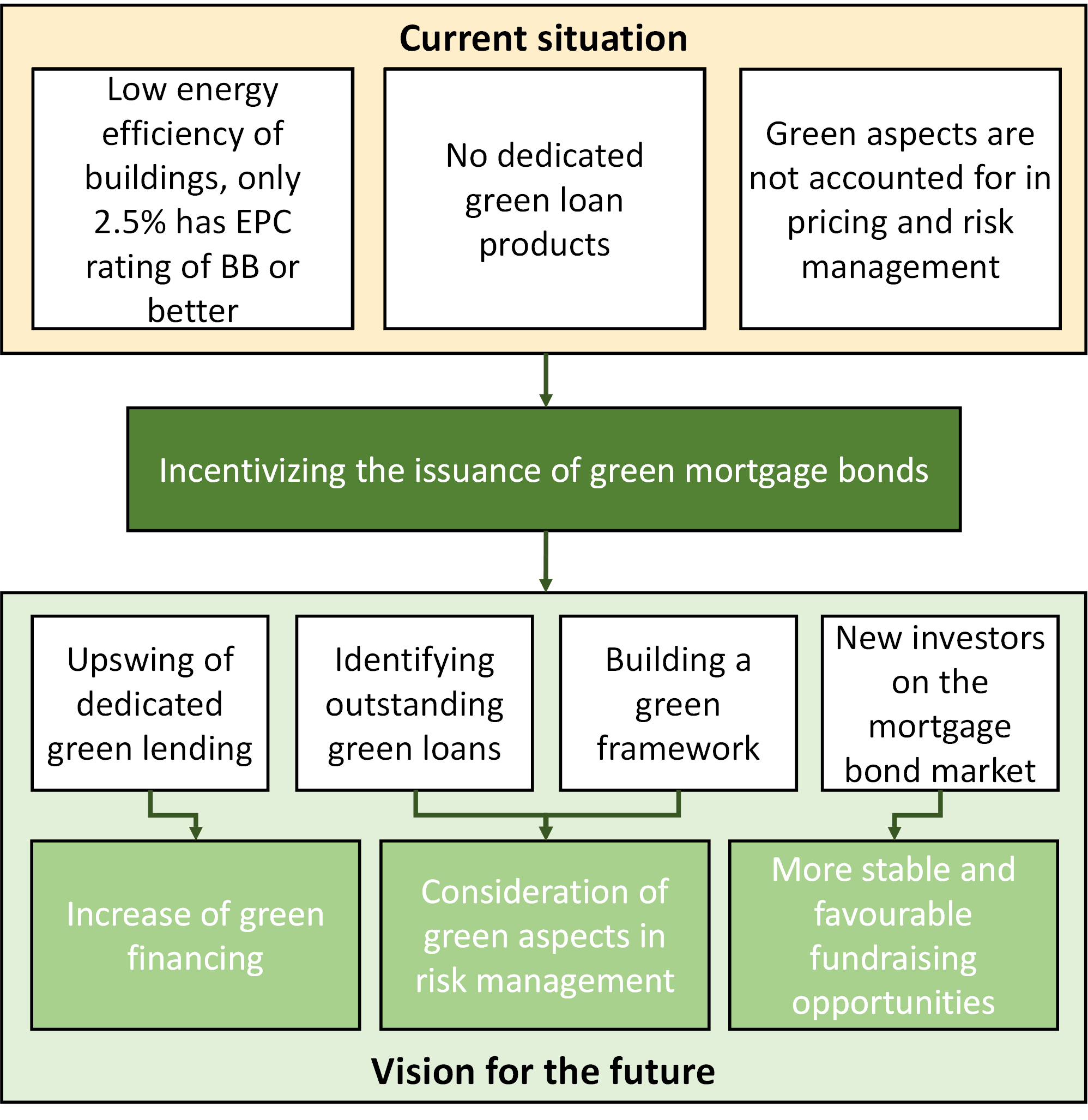

The amendment - in accordance with the MNB's Green Mortgage Bond Purchase Program - encouraged the domestic issuance of green mortgage bonds and, through this, the spread of mortgage loans financing green real estate. On the one hand, these support the reduction of energy consumption by financing the improvement of the currently low energy efficiency of the housing stock, and on the other hand, based on previous international experience, they may also have more favourable credit risk characteristics, and therefore may also have a positive effect on financial stability. Furthermore, due to the increasing interest in green investments, green mortgage bonds may represent a new, more diversified and stable source of funding for the banking sector in the future.

Effects of the emergence of green mortgage bonds

Note: based on the 2021 Macroprudential Report. Source: MNB

As a result of the measure, in 2021 all banks issued green mortgage bonds.

The annual Macroprudential report of the MNB elaborates in detail on domestic mortgage bond market processes and the development of green mortgage bond portfolios.

Related professional articles (only in Hungarian):

More details regarding the Mortgage Funding Adequacy Ratio (MFAR)