Certified Consumer-friendly Housing Loans for green lending objectives

In order to stimulate banking competition, with financial stability and consumer protection aspects in mind, the MNB introduced the Certified Consumer-friendly Housing Loan (CCHL) certification from June 2017. The purpose of the program was to strengthen the transparency and comparability of loan products, thereby increasing the intensity of banking competition and promoting the spread of longer-term fixed interest rate products.

The certification, which functions as a trademark, could only be obtained for banks housing loan products that meet the conditions specified in the certification framework. Qualified bank housing loans are exclusively with:

- annuity repayments,

- an interest rate fixed for at least 5 years or until the end of the term,

- an interest mark-up above the reference interest rate of at most 3.5 percentage points.

The fees of the CCHL loans, such as the disbursement and prepayment fees, are more favourable than the legal maximums, and the deadlines available for the administration of housing loans are also maximized.

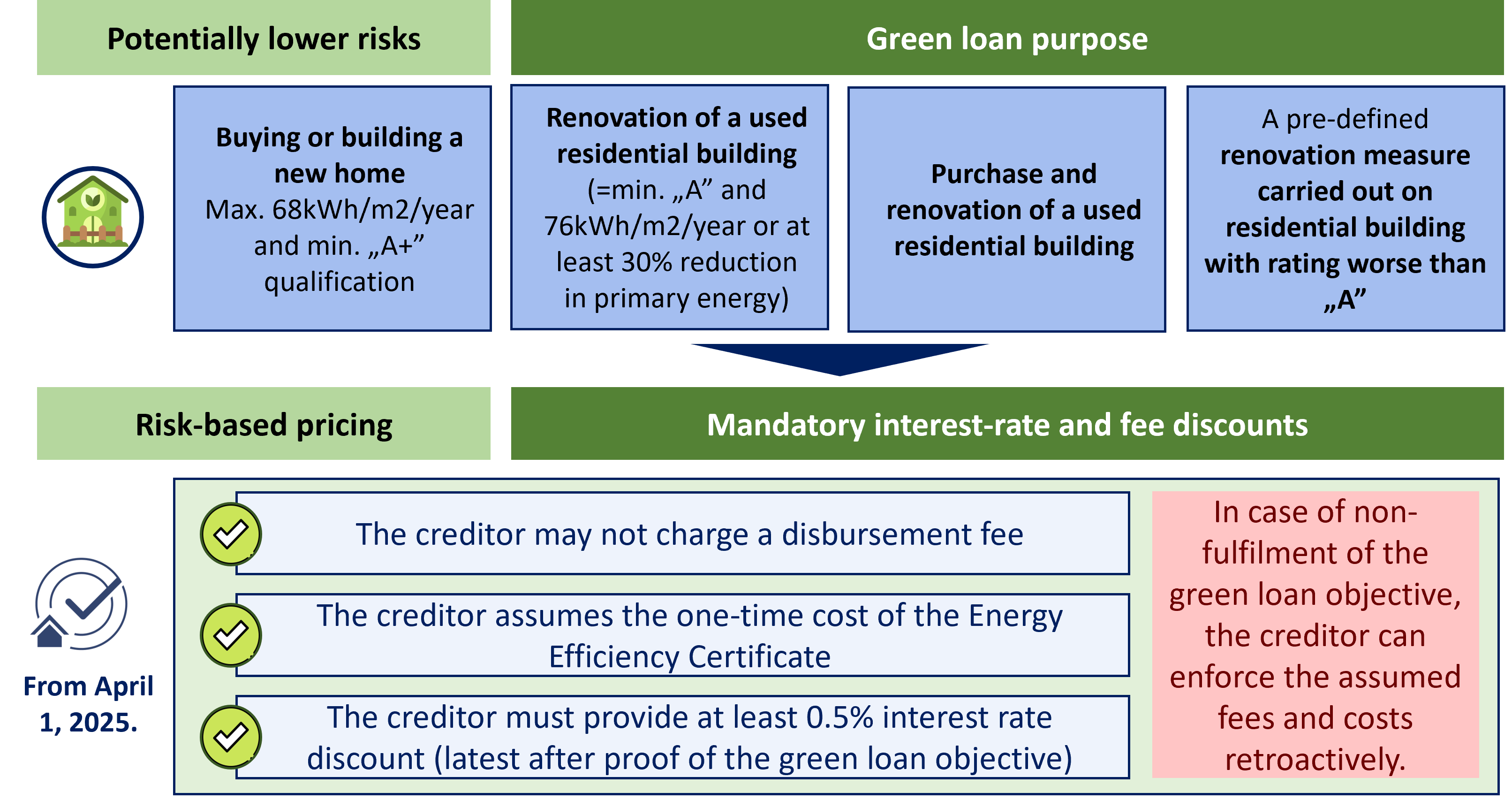

In order to promote the energy modernization of the residential real estate stock, the development of dedicated green housing loan products, and to encourage banking sector financing of green loan purposes, the MNB decided to introduce – in accordance with its Green Preferential Capital Treatment Programme – CCHL loans with a dedicated green loan objective from April 1, 2023.

From April 1, 2025, in order to further facilitate the bank financing of green real estate and thereby support the improvement of the energy efficiency of Hungarian real estate, the MNB made it mandatory for lenders that offer CCHL to provide borrowers with their CCHL loans available for their specific green loan purposes as a green loan.

In addition, in case of verified completion of the green loan purpose, customers must benefit from an interest rate discount of at least 0.5 percentage points (compared to a CCHL loan granted for an identical but non-green purpose), and the bank must make up the disbursement fee and the fee for an Energy Efficiency Certificate (EEC) from the borrower, if the preparation of an EEC is necessary to prove the fulfilment of the green loan objective and the borrower is responsible for its cost.

Green requirements of the Certified Consumer-friendly Housing Loan framework

In the case of the following green loan objectives defined in the Certification Framework it is mandatory to provide green interest rate discount, and no disbursement fee, nor fees and other costs related to the verification of the green loan objective can be charged:

1) construction or purchase of a new apartment, purchase of a building plot for the purpose of building a new apartment (if the new apartment will be built within 4 years of the purchase of the plot), as well as the construction or purchase of a car storage or storage unit connected to the new apartment (at the same time as the new apartment), if the calculated value of the total energy characteristic (primary energy demand) determined in accordance with EKM decree 9/2023 (V. 25.) on the determination of the energy characteristics of buildings (EKM decree) is no more than 68 kWh/m²/year, and the Energy Efficiency Certificate (hereinafter: EEC) has an energetic quality classification of at least "A+" according to Government Decree 176/2008 (VI.30.) on the energy certification of buildings; or

2) renovation of a used residential building that:

- at the time of acceptance of the loan application, based on the EEC it concerns a residential building classified worse than "A" according to the EKM decree or a residential building verifiably built before 1990, and as a result of the renovation the classification of the residential building reaches or exceeds the "A" rating according to the EKM decree, and the total energy characteristic of the renovated residential building does not exceed the level of 76 kWh/m²/year; or

- affects a residential real estate where the renovation results in a reduction of primary energy usage of at least 30% compared to the aggregate energy characteristic included in the EEC valid at the time of the conclusion of the contract;

3) sale and purchase of a used residential building on which renovation according to point 2) is carried out after the conclusion of the loan agreement; or

4) implementation of one or more of the following renovation measures on residential real estate that has an energy performance rating lower than “A” according to EKM decree:

- Installation of solar photovoltaic modules or solar hot water panels

- Installation of ground-source, air-water, air-air heat pumps

- Installation of wind turbines

- Installation of thermal and electric energy storage units

- Thermal insulation for building delimiting structures

- Replacement of external doors and windows with energy efficient doors and windows

- Installation of shading technology

- Installation, replacement or renovation of heating, cooling or ventilation systems, in-cluding connection to the district heating system

- Installation of efficient lighting appliances and systems

- Installation of low-flow kitchen, and sanitary water fittings

- Installation of third-generation smart meters for electricity load monitoring

- Installation of zoned thermostat systems, smart thermostat systems and sensoring equipment (e.g. motion and day light control)

- Installation of Building Management Systems (BMS)

More information about the CCHL certification framework is available at the following link (only in Hungarian):

Minősített Fogyasztóbarát Lakáshitel (minositetthitel.hu).

Certified Consumer-friendly Personal Loans for green lending objectives

Following the initial success of the Certified Consumer-friendly Housing Loan products, the MNB decided to expand the certification framework and introduced the Certified Consumer-friendly Person Loan (CCPL) certification from January 2021. The main aspect of the development of CCPL products was to strengthen the transparency and comparability of loan products, thereby increasing the intensity of banking competition and promoting the spread of longer-term fixed interest rate products.

The certification, which functions as a trademark, could only be obtained for banks’ personal loan products that meet the conditions specified in the certification framework. Qualified bank personal loans are exclusively with:

- a maturity of up to 7 years,

- an interest rate fixed until the end of the term,

- a spread not exceeding 15 percentage points up to a loan amount of HUF 500,000, and 10 percentage points above HUF 500,000.

The fees of the CCPL loans, such as the disbursement and prepayment fees, are more favourable than the legal maximums, and the deadlines available for the administration of personal loans are also maximized. In addition, in the case of consumer-friendly personal loans, a fully comprehensive online loan application process is available to all customers.

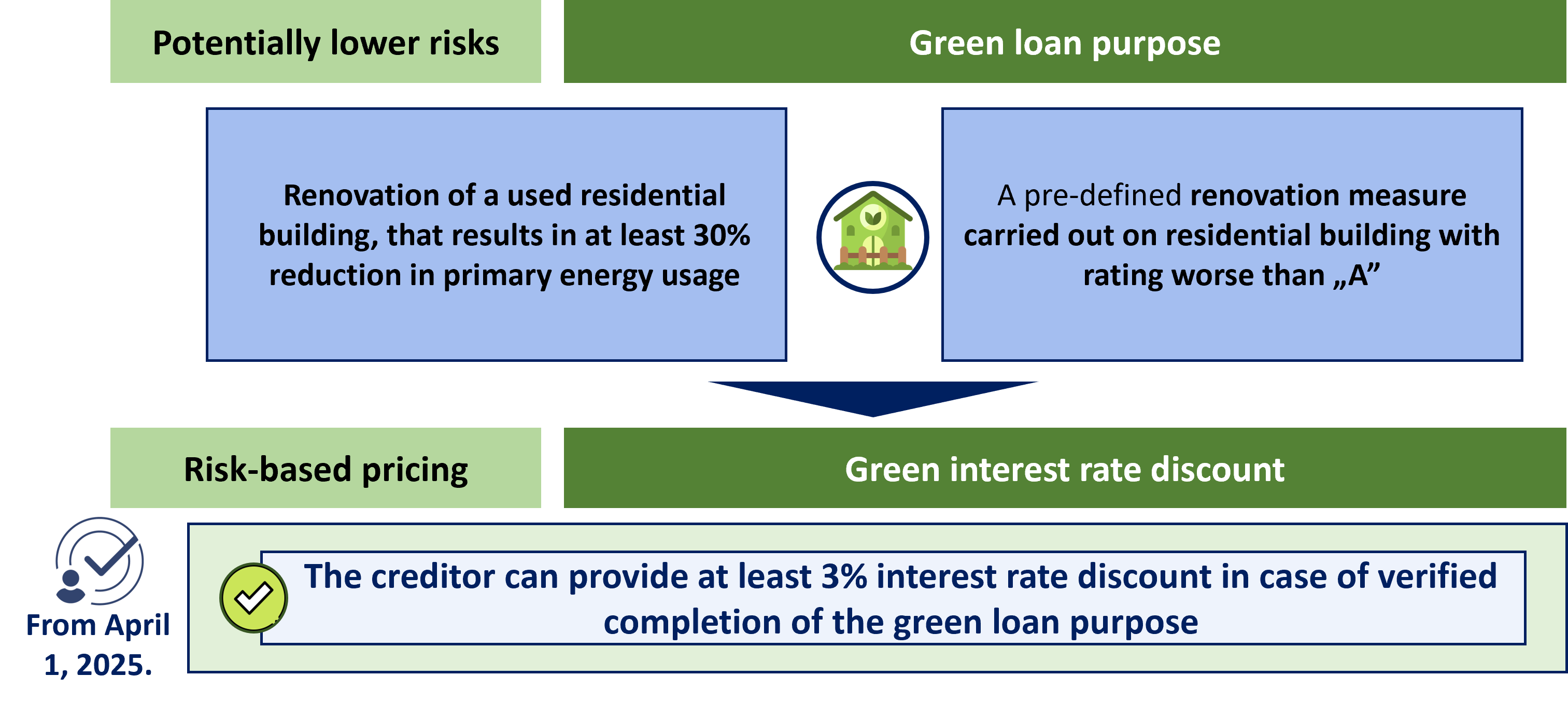

In order to promote the energy renewal of the domestic real estate stock, the MNB also decided on a green review of the Certified Consumer-friendly Personal Loan certification. The purpose of the amendment is to encourage the introduction of loan products that are available to a wide range of customers and provide financing for green loan purposes under favorable conditions.Based on the decision of the MNB, from April 2025, in the case of the certified fulfilment of the green loan purposes defined in the CCPL conditions, the lender may provide a dedicated green interest rate discount of at least 3 percentage points from the non-discounted interest rate. The following green loan purposes can be financed with CCPL products:

a) renovation of a used residential building, that affects a residential real estate where the renovation results in a reduction of primary energy usage of at least 30% compared to the aggregate energy characteristic included in the Energy Efficiency Certificate valid at the time of the conclusion of the contract;

b) implementation of one or more of the following renovation measures on residential real estate that has an energy performance rating lower than “BB” according to TNM decree 7/2006. (V. 24.) on determination of the energy characteristics, or lower than “A” according to EKM decree 9/2023 (V. 25.) on the determination of the energy characteristics:

- Installation of solar photovoltaic modules or solar hot water panels

- Installation of ground-source, air-water, air-air heat pumps

- Installation of wind turbines

- Installation of thermal and electric energy storage units

- Thermal insulation for building delimiting structures

- Replacement of external doors and windows with energy efficient doors and windows

- Installation of shading technology

- Installation, replacement or renovation of heating, cooling or ventilation systems, in-cluding connection to the district heating system

- Installation of efficient lighting appliances and systems

- Installation of low-flow kitchen, and sanitary water fittings

- Installation of third-generation smart meters for electricity load monitoring

- Installation of zoned thermostat systems, smart thermostat systems and sensoring equipment (e.g. motion and day light control)

- Installation of Building Management Systems (BMS)

Green requirements of the Certified Consumer Friendly Personal Loan framework

More information about the CCPL certification framework is available at the following link (only in Hungarian):Minősített Fogyasztóbarát Személyi Hitel.