Biodiversity and ecosystem services underpin all economic activity and human well-being. According to the estimates of the World Economic Forum, more than half of the world's total GDP depends on nature and its services. Despite this, we are witnessing an unprecedented destruction of our biodiversity and natural treasures.

Recognizing the risks inherent in this process, the MNB launched a pioneering project together with the OECD in September 2022. The two-year project aimed to map the financial risks arising from the decline of biodiversity, and at the same time to develop the supervisory framework of the MNB. Its implementation was supported by applying the technical support instrument (TSI) of the European Commission’s Directorate-General for Structural Reform Support (DG REFORM).

In 2023, in the first half of the project, the OECD developed a methodological supervisory framework for central banks, identifying risk sources and transmission channels. The framework enables central banks to identify and prioritize biodiversity-related risks. In June 2023, this general framework was presented by the colleagues of the OECD at a successful webinar to around 150 participants from more than 40 countries.

In 2024, the methodological supervision framework was implemented to the Hungarian financial system, as the final product of the project. The framework is titled as „Technical implementation of the Supervisory Framework for Assessing Nature-related Financial Risks to the Hungarian financial sector”. Among others, it quantifies the macroeconomic and financial effects of biodiversity shocks in 4 steps, in the case of several scenarios:

- For example, its results show, that because of shocks of different severity, the domestic GDP can show a 4-7% decline, and the proportion of non-performing loans can increase by 1-3%.

The framework also formulates supervisory recommendations based on the 4-step analysis in order to reduce these risks.

The closing event of the project and the launch of the framework took place on 07 June 2024, at the International Biodiversity Conference, at MNB’s Supervisory Centre. The event was jointly organized by the MNB, the OECD and the European Commission, and the Taiex technical assistance instrument also contributed to its financing. You can learn more about the TAIEX TSI MNB-OECD-EC Launch Event, including its presentations, at this link.

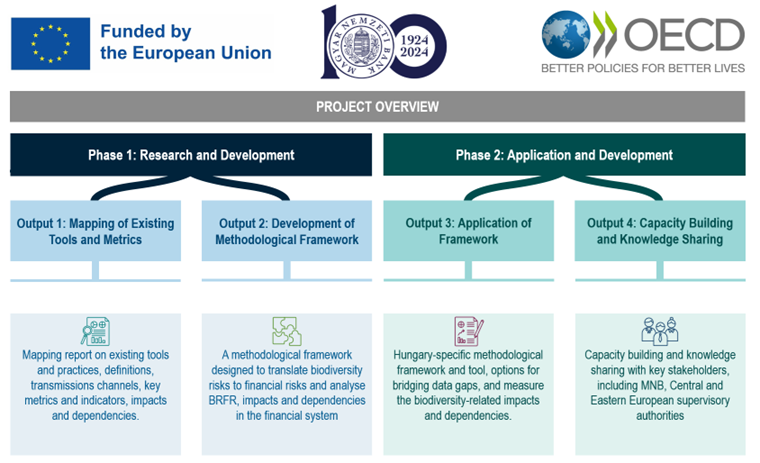

Project overview:

Outputs of the project

- Technical implementation of the Supervisory Framework for Assessing Nature-related Financial Risks to the Hungarian financial sector | June 2024 |

- Github: The Stata code used for the analysis, which also contains the instructions for use

- TAIEX TSI MNB-OECD-EC Launch Event: Technical implementation of the Supervisory Framework for Assessing Nature-related Financial Risks to the Hungarian financial sector | June 2024 |

- Agenda

- PowerPoint presentations

- A supervisory framework for assessing nature-related financial risks: Identifying and navigating biodiversity risks | September 2023 |

- PowerPoint presentation

- OECD-INSPIRE workshop: Assessing biodiversity-related risks, impacts and dependencies in the financial sector | April 2023

- Policy Paper: Assessing biodiversity-related financial risks. Navigating the landscape of existing approaches | April 2023

Press releases

- 2024: MNB Green Programme: financial risks of biodiversity loss can be measured and evaluated

- 2023: MNB Green Programme: results of the Biodiversity project to date have been presented

- 2022: MNB Green Programme: project launched to assess financial risks related to biodiversity loss

The trilateral project team: